And for the daily person, it might be more accessible than you believe - How to get started in real estate investing. Although it requires significant time, patience, and (of course) cash, nearly anyone can buy property. Here are 6 methods you can participate this investment-turned-pop-culture-phenomenon. Realty crowdfunding is a method that enables business to raise capital from large groups of individuals. It's done via online platforms that supply a meeting ground/marketplace in between property designers and interested financiers. In exchange for their cash, investors get financial obligation or equity in an advancement project and, in successful cases, regular monthly or quarterly distributions. Not all realty crowdfunding platforms are offered to everybody: Many are reserved for recognized financiers that is, high-net-worth, and/or extremely skilled individuals.

Through these websites, you develop an account and either select a portfolio method based on your goals, with brokers diversifying your money throughout a series of investment funds, or browse and select investments yourself, keeping up with their progress through a 24/7 online control panel. Despite their benefit, crowdfunding offerings come along with substantial threat. As private financial investments, they're not as liquid (easily sold) as other openly traded securities, like stocks. Consider your funds as being tied-up over the long-lasting. Fundrise suggests investors have a time horizon of at least five years, for instance. If you wish to wade into property, buying Look at this website a property financial investment trust (REIT) will provide direct exposure to the marketplace without the time and cost commitment of buying your own property.

Like shared funds or exchange-traded funds, they own not simply one, however a basket of properties. Investors purchase shares of a and make an in proportion share of the earnings produced by those properties. Equity REITs, the most common kind of REIT, enable investors to pool their cash to money the purchase, development, and management of realty residential or commercial properties. A REIT focuses on a particular type of realty, such as home complexes, hospitals, hotels, or shopping malls. Ninety percent of its annual incomes must be distributed to the financiers as dividends. One big selling point of REITs: The majority of them trade on public stock exchanges.

Geared towards generating income, typically from rent and leases, REITs offer routine returns and high dividends. They likewise attract financiers because of the special method that they are taxed: REITs are structured as pass-through entities, indicating they do not pay business tax. This successfully indicates greater returns for their investors. If you want to keep your financial investment liquid, stay with openly traded REITs (a few REITs are private ventures). You can purchase shares through a brokerage company, IRA, or 401( k). A property restricted partnership (RELP) provides financiers with a diversified portfolio of realty financial investment chances, enabling you to combine your funds with other investors' to purchase, lease, develop, and offer properties that would be tough to manage or manage individually.

Mainly: RELPs are a form of private equity that is, they are not traded on public exchanges, Rather, they exist for a set term, which typically lasts in between 7 and 12 years. During this term, RELPs work like little business, forming a service plan and recognizing homes to purchase and/or establish, handle, and lastly sell off, with profits dispersed along the method. After the holdings are all dispatched, the collaboration dissolves. They're normally better for high-net-worth investors: The majority of RELPs have a financial investment minimum of normally $2,000 or above, and frequently significantly more some set minimum "buy-ins" anywhere from $100,000 to a few million, depending on the number and size of the property purchases.

An Unbiased View of How To Get A Real Estate License In Ca

Being a landlord can can be found in numerous forms. The very first is to purchase a single-family house and rent it out, a method that will just generate income if overhead expenses are low. If your tenant's rental payment does not cover the mortgage, insurance,, and upkeep, you're efficiently losing cash. Ideally, your monthly home mortgage payment will be fairly repaired, while rent prices rise, increasing the quantity of money you pocket in time. Nowadays, you can buy rental residential or commercial properties online through a website like Roofstock, which enables sellers of uninhabited homes primed for occupants to list their properties, helps with the buying procedure, and assigns a home manager to the new buyer.

This method reduces your living expenditures while simultaneously creating income that can cover mortgage payments, taxes, and insurance. A low commitment version of house-hacking is to lease part of your house by means of a site like Airbnb, which would allow you some additional monthly cash without having to commit to taking on a long-term renter. On the opposite, more enthusiastic end, you could go for a condominium conversion, in which you purchase a multifamily building, lease the units, and then later turn the systems into apartments and sell them off individually, says Boston-based real estate agent and real estate what is time share vacation financier Dana Bull.

Some individuals take it a step further, buying homes to refurbish and resell. Though those TELEVISION programs typically make it look simple, "flipping" remains among the most lengthy and costly ways to purchase property. But it also has the prospective to produce the greatest gains (How does a real estate agent get paid). To be an effective flipper, you need to constantly be prepared for unanticipated problems, spending plan boosts, time-inducing errors, a longer remodelling timeline, and concerns selling on the marketplace. It's particularly essential to develop a team of professionals contractors, interior designers, attorneys, and accounting professionals you can trust. And make certain you have the money reserves to repair.

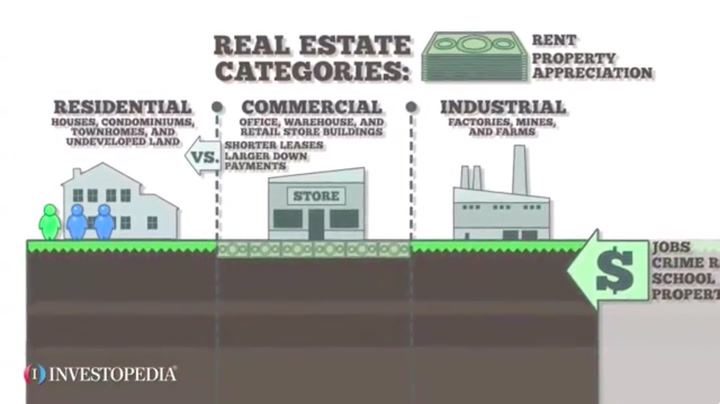

Finally, if you want to buy genuine estate, look closer to home your own home. Homeownership is an objective numerous Americans aim to achieve, and rightfully so. Residential realty has actually had its ups and downs throughout the years, however it generally values in the long-lasting. Many folks don't purchase a home outright, however get a mortgage. Working to paying it off, and owning your house outright, is a long-term investment that can secure against the volatility of the property market - What is adu in real estate. It's typically viewed as the action that precedes investing in other types of property and has the included benefit of boosting your net worth, since you now own a significant property.

Real estate is an especially pricey financial investment, so you need to have money on hand for a deposit, partnership share, or to purchase a home outright. You'll likewise require a reserve to dip into if and when something requires repairing, which should be completely different from your everyday emergency fund. Prior to getting going, develop an emergency situation fund, pay off customer debt, and automate your retirement savings. There's an old expression: "The three most crucial elements in property are location, place, location." Start by being familiar with the local market. Talk to realty representatives and locals; learn who resides in the area, who is relocating to the area, and why; and examine the history of residential or commercial property costs.